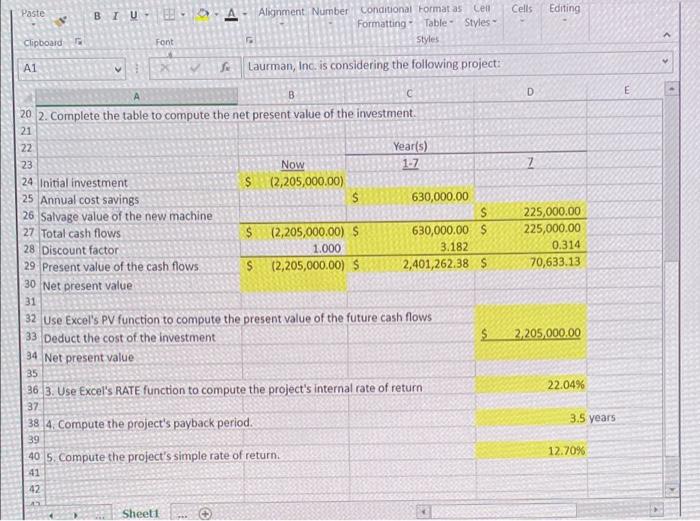

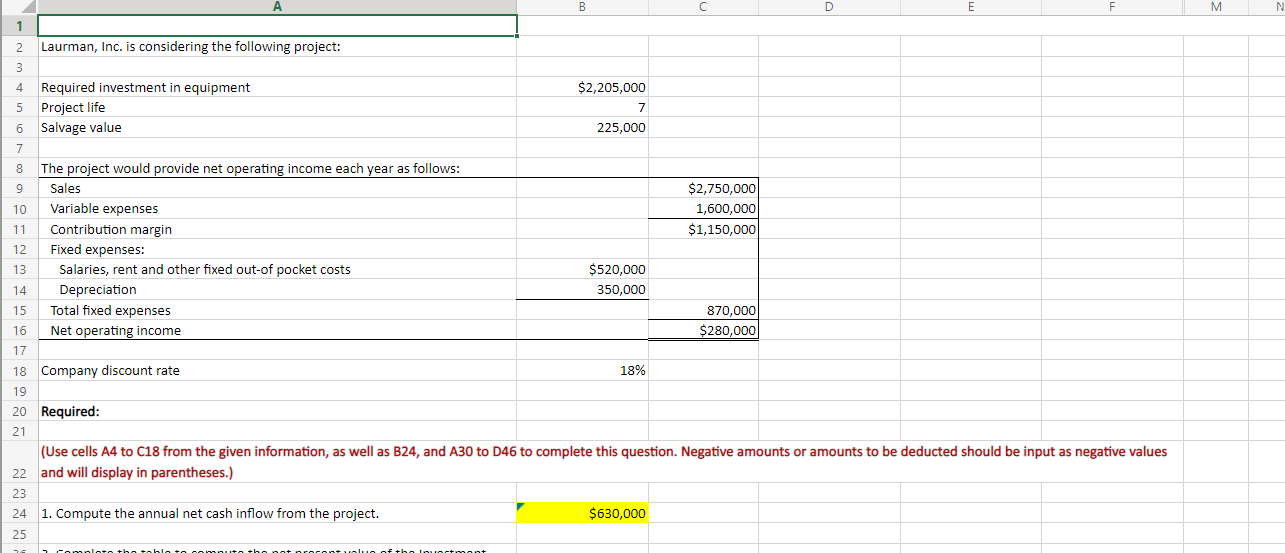

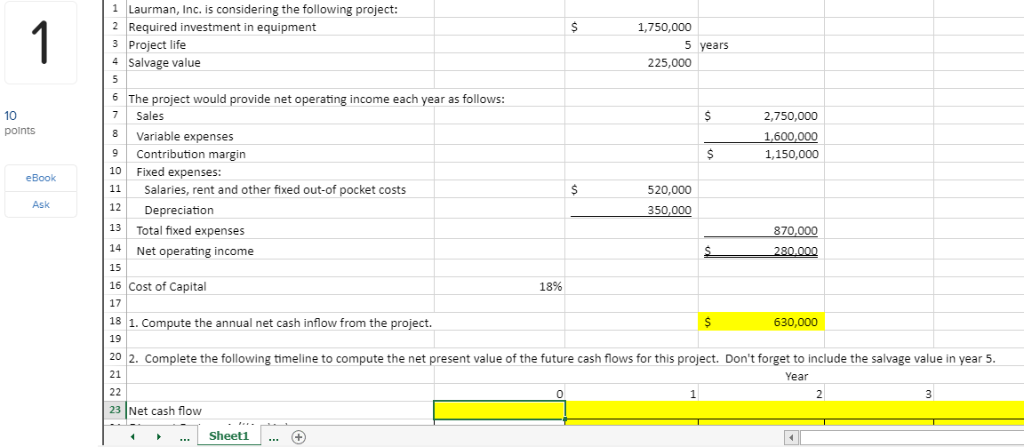

1 2 Laurman, Inc. is considering the following project: 3 4 Required investment in equipment 5 Project life 6 Salvage value 7 8 9 The project would provide net operating income each year as follows: Sales Variable expenses 10 11 Contribution margin 12 13 14 15 16 Fixed expenses: Salaries, rent and other fixed out-of pocket costs Depreciation Tot

Solved Laurman, Inc. is considering a new project and has | Chegg.com

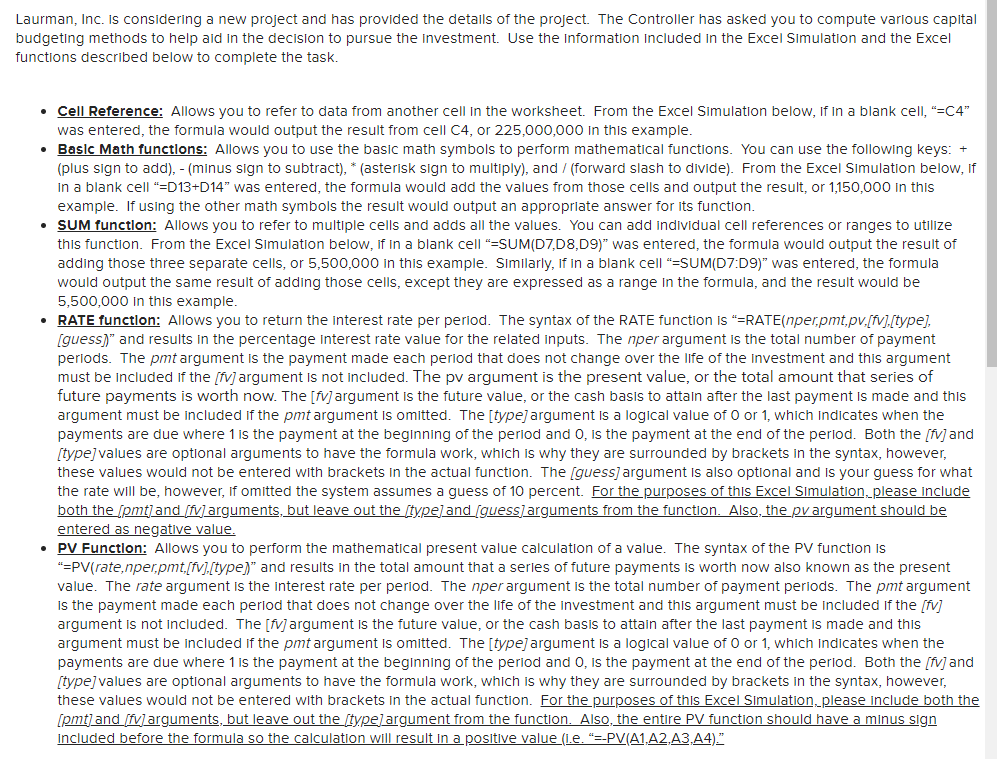

Laurman, Inc. is considering investing in a new project. Use the following information to answer the questions below: The project would provide net operating income each year as

Source Image: chegg.com

Download Image

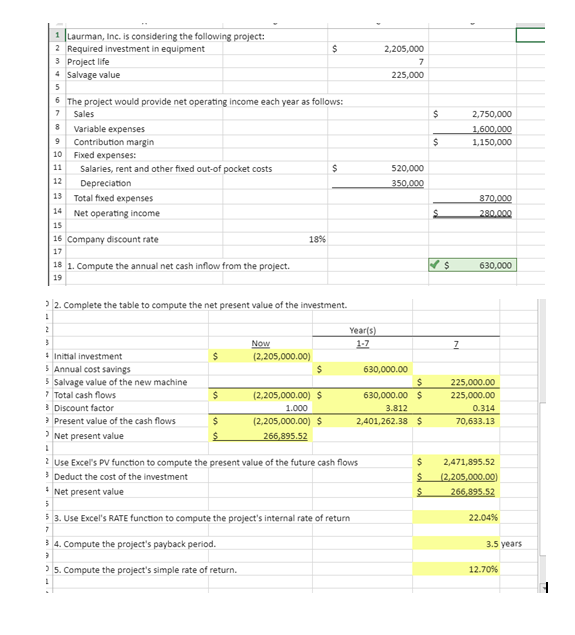

Laurman, Inc. is considering the following project: Required investment in equipment Project life 2,205,000 7 Salvage value 225,000 The project would provide net operating income each year as follows: Sales 2,750,000 Variable expenses 1,600,000 Contribution margin 1,150,000 Fixed expenses: Salaries, rent and other fixed out-of pocket costs 24 52

Source Image: chegg.com

Download Image

Solved 1 Laurman, Inc. is considering the following project: | Chegg.com Aug 3, 2023Laurman, Incorporated is considering the following project: Required investment is equipment $17,500,000 Project life: 5 years Salvage value: 2,250,000 The project would provide net operating income each year as follows: Sales $27,500,000 Veriable expenses 16,000,000 Contribution margin 11,500,000 Fixed expenses 5,200,000 Depreciation 3,500,000

Source Image: chegg.com

Download Image

Laurman Inc Is Considering The Following Project

Aug 3, 2023Laurman, Incorporated is considering the following project: Required investment is equipment $17,500,000 Project life: 5 years Salvage value: 2,250,000 The project would provide net operating income each year as follows: Sales $27,500,000 Veriable expenses 16,000,000 Contribution margin 11,500,000 Fixed expenses 5,200,000 Depreciation 3,500,000 Finance questions and answers. Laurman, Inc. is considering the following project: Required investment in equipment Project life Salvage value The project would provide net operating income each year as follows: \begin tabular r \hline 9 & Sales & $2,750,000 \\ \hline 10 & Variable expenses & 1,600,000 \\ \hline 11 & Contribution

Solved Laurman, Inc. is considering the following project: | Chegg.com

1 Laurman, Inc. is considering the following project: 2 Required investment in equipment 3 Project life 4 Salvage value 2,205,000 7 225,000 6 The project would provide net operating income each year as follows: 7 Sales 8 Variable expenses 9 Contribution margin 10 Fixed expenses: 2,750,000 1,600,000 1,150,000 11 Salaries, rent and other fixed out Chap11-Rev – reviewer – REVIEW PROBLEM: COMPARISON OF CAPITAL BUDGETING METHODS Lamar Company is – Studocu

Source Image: studocu.com

Download Image

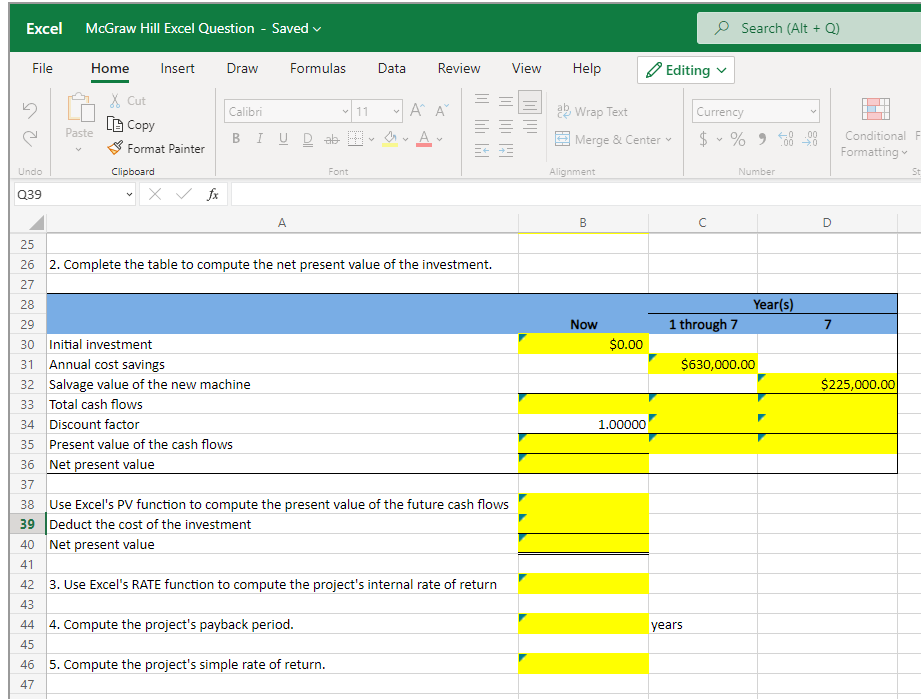

Solved] Hi I need help with this. I need answers in the form of formulas… | Course Hero 1 Laurman, Inc. is considering the following project: 2 Required investment in equipment 3 Project life 4 Salvage value 2,205,000 7 225,000 6 The project would provide net operating income each year as follows: 7 Sales 8 Variable expenses 9 Contribution margin 10 Fixed expenses: 2,750,000 1,600,000 1,150,000 11 Salaries, rent and other fixed out

Source Image: coursehero.com

Download Image

Solved Laurman, Inc. is considering a new project and has | Chegg.com 1 2 Laurman, Inc. is considering the following project: 3 4 Required investment in equipment 5 Project life 6 Salvage value 7 8 9 The project would provide net operating income each year as follows: Sales Variable expenses 10 11 Contribution margin 12 13 14 15 16 Fixed expenses: Salaries, rent and other fixed out-of pocket costs Depreciation Tot

Source Image: chegg.com

Download Image

Solved 1 Laurman, Inc. is considering the following project: | Chegg.com Laurman, Inc. is considering the following project: Required investment in equipment Project life 2,205,000 7 Salvage value 225,000 The project would provide net operating income each year as follows: Sales 2,750,000 Variable expenses 1,600,000 Contribution margin 1,150,000 Fixed expenses: Salaries, rent and other fixed out-of pocket costs 24 52

Source Image: chegg.com

Download Image

Solved Assume you are the plant accountant for your company. | Chegg.com 1 Laurman, Inc. is considering the following project: 2 Required investment in equipment 2,205,000 3 Project life 4 Salvage value 225,000 6 The project would provide net operating income each year as follows: 7 Sales 8 Variable expenses 9 Contribution margin 10 Fixed expenses: 11Salaries, rent and other fixed out-of pocket costs 12Depreciation 1

Source Image: chegg.com

Download Image

Solved Laurman, Inc. is considering the following project: | Chegg.com Aug 3, 2023Laurman, Incorporated is considering the following project: Required investment is equipment $17,500,000 Project life: 5 years Salvage value: 2,250,000 The project would provide net operating income each year as follows: Sales $27,500,000 Veriable expenses 16,000,000 Contribution margin 11,500,000 Fixed expenses 5,200,000 Depreciation 3,500,000

Source Image: chegg.com

Download Image

Solved Laurman, Inc. is considering a new project and has | Chegg.com Finance questions and answers. Laurman, Inc. is considering the following project: Required investment in equipment Project life Salvage value The project would provide net operating income each year as follows: \begin tabular \hline 9 & Sales & $2,750,000 \\ \hline 10 & Variable expenses & 1,600,000 \\ \hline 11 & Contribution

Source Image: chegg.com

Download Image

Solved] Hi I need help with this. I need answers in the form of formulas… | Course Hero

Solved Laurman, Inc. is considering a new project and has | Chegg.com Laurman, Inc. is considering investing in a new project. Use the following information to answer the questions below: The project would provide net operating income each year as

Solved 1 Laurman, Inc. is considering the following project: | Chegg.com Solved Laurman, Inc. is considering the following project: | Chegg.com 1 Laurman, Inc. is considering the following project: 2 Required investment in equipment 2,205,000 3 Project life 4 Salvage value 225,000 6 The project would provide net operating income each year as follows: 7 Sales 8 Variable expenses 9 Contribution margin 10 Fixed expenses: 11Salaries, rent and other fixed out-of pocket costs 12Depreciation 1